salt tax impact new york

The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for many middle-class residents of high-taxed states like New York where property taxes on a downstate suburban house can approach or exceed the limit.

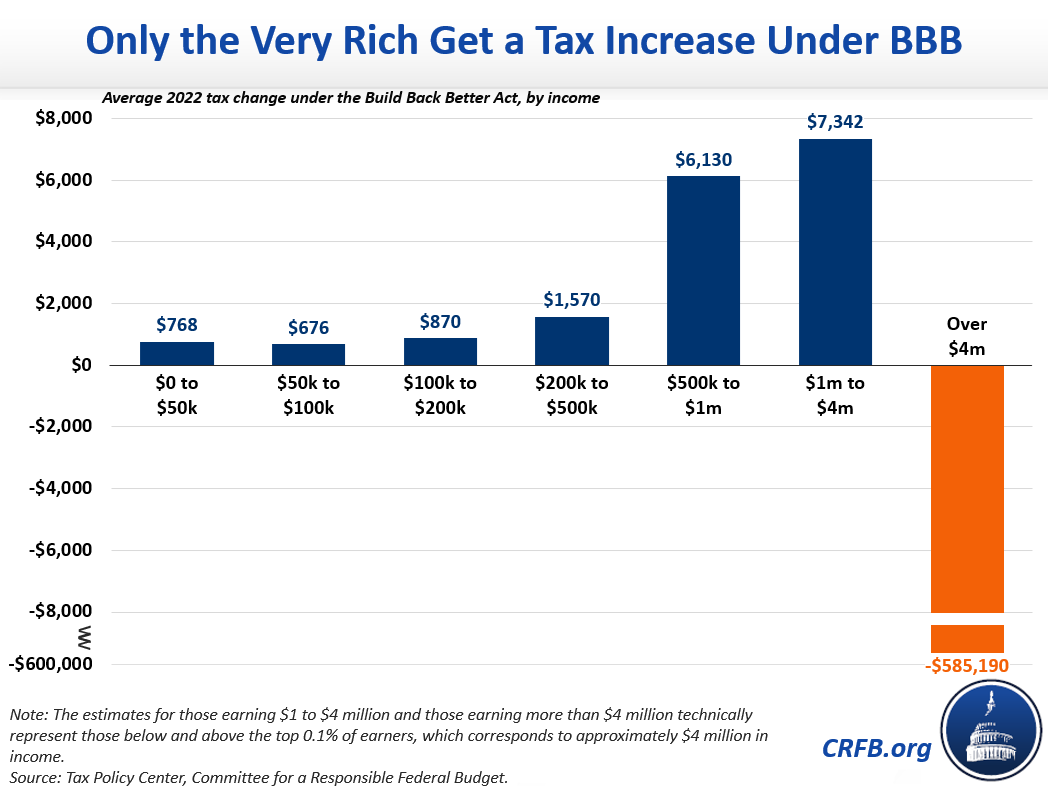

Biden S Safety Net Package Would Raise Not Lower Taxes On Millionaires New Estimates Show

On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. The climate change deal brewing in Congress which would fund the massive investment in clean energy with new taxes on corporations came. Josh Gottheimer conducts a news conference to advocate for inclusion of the state and local tax SALT deduction in the.

Rather than repealing SALT especially now when the need to spend on public health and education is clearer than ever the limit on. It is useful to compare the distributional impact of SALT cap repeal to other tax policies or packages. Were hiring for an Tax Manager - State and Local SALT for our New York City office.

Mikie Sherrill D-NJ recently. Almost 11 million taxpayers are likely to feel the pinch of a new cap on deducting state and local taxes also known as SALT deductions. This consequential tax legislation available to electing pass-through entities provides a mechanism for New York State individual taxpayers to limit the impact of the.

22168 more than. The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. This report shows that the cap which is effectively a tax increase for New Yorkers is having a sustained negative effect on employment and output in New York State.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly unfair risk of being taxed twice on. April 7 2021 Louis Vlahos Tax.

SALT limits impact ALL New Yorkers. New York States new budget for 2022 included an elective Pass-Through Entity Tax PTE and a corresponding personal income tax credit regime which will allow NYS taxpayers to avoid some of the impact of the SALT limit. One obvious point of.

Cuomos initial budget proposal in January and it comes at a time when many Democrats are calling on Pres. The 10000 cap on state and local tax deductions for now may be here to stay however. Of New Yorks.

As a Tax Manager - State and Local SALT you will be responsible for planning and completing engagements in various areas of state and local taxation including but not limited to multistate incomefranchise tax salesuse tax and unclaimed property. Lifting the SALT cap much more pro-rich than Trumps tax bill. Statewide average SALT totals.

The provision was part of Gov. House Democrats drew a red line on taxes. WASHINGTON A plan by House Democrats to reduce taxes for high earners in states like New Jersey New York and California in their 185 trillion social policy spending package.

After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000. The SALT deduction cap would stay at 10000. The cap affects high tax states like New York.

The Rockefeller Institute of Government and the New York State Division of the Budget have examined the impact of the SALT cap. Now they may fold for Pelosi. Scott is a New York attorney with extensive.

Before President Donald Trump signed the Tax Cuts and Jobs. The SALT cap increase will have the biggest effect on high-income-tax states like New York California and New Jersey said certified financial planner Matthew Benson owner at Sonmore Financial. New York represents 73 of the pre-cut tax base.

New York supports 107000 fewer additional. More than 50 of families in my district took the SALT deduction before it was capped in 2017 said Rep. The average SALT burden is over 10000 in.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

San Francisco S Painted Ladies In The Alamo Square Neighborhood Is One Of The Most Photographed Loc San Francisco Restaurants San Francisco Visit San Francisco

State And Local Tax Salt Deduction Salt Deduction Taxedu

East Coast Lawmakers Pepper Congress With Pleas For Salt Tax Break Iowa Capital Dispatch

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

About 30 Million People Lost These Tax Breaks In 2018

Us Commercial Real Estate Prices Plunged In April Mall Prices Collapsed Naked Capitalism

Nyc Home Prices Plunge After Salt Deductions Capped

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget